As business advisors, we can help you get your house in order when filing taxes to ensure you don’t have to pay Uncle Sam more than what’s necessary. The Bottom Line for Income Tax BracketsįMA CPA is a CPA firm in Clearwater, specializing in helping individuals and small business owners with all matters of tax preparation and tax planning. If your standard deduction is less than your other deductions combined, it’s best to itemize your deductions and save money.

#2021 TAX BRACKETS FILING SINGLE PLUS#

But taking the standard deduction means you cannot deduct home mortgage interest, medical expenses, plus charitable donations from your tax bill. The IRS allows you to take the standard deduction on a no-questions-asked basis. Let’s look at the 20 tax years, where the standard deduction is as follows: Additionally, there’s a defined dollar amount that lowers your taxable income. For instance, you can deduct property taxes and the mortgage interest paid on a home loan.

You can also lower your income using tax deductions.

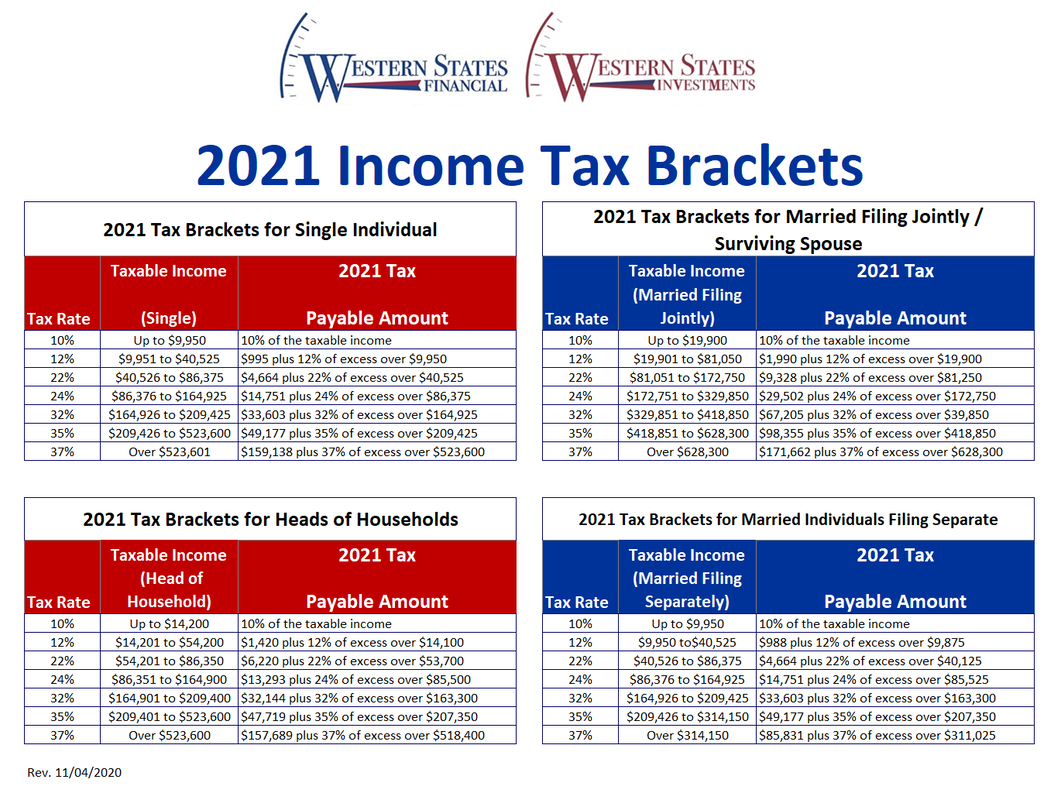

Lifetime learning credit to offset the costs of post-secondary education.Child tax credit to defray the costs for childcare for dependents under age 13.Earned income tax credits to offset the burden of Social Security taxes.Several tax credits exist to help low-income and middle-income households reduce the amount of taxes they owe. Fortunately, you can lower your tax bill through tax credits and tax deductions. No one wants to pay higher taxes than they need to. As you can see, the last dollar you earn is taxed more than the first dollar you earn – this is technically the principle of a progressive tax system. The first $10,275 will be taxed at 10% resulting in a tax of $1,027.50.Your marginal tax rate is 22%, but here’s how your taxes will be broken down. Let’s say you’re a single taxpayer with a taxable income of $80,000 in tax year 2021. However, not all your income is levied at this rate across the board. The tax bracket your top dollar falls into is your marginal tax rate. That’s why most people opt to work with a CPA firm for tax planning and business advisory services. Tax brackets are not as intuitive as they seem at first glance because odds are you’ll have to look at more than one tax bracket to figure out your effective tax rate. $539,900 and above How Federal Income Tax Brackets WorkĪlmost everyone agrees that the current tax system is too complicated. As such, here are the tax brackets for taxes due April 2023 or October 2023, with an extension. In November 2021, the IRS provides tax inflation adjustments for tax year 2022. The tax rates for married couples filing separately become: Married Filing Jointly and Qualifying Widow(er)sįor married couples filing separately, the tax brackets are similar to single filers, with deviations coming in for incomes above $209,425. Here’s a look at the brackets and tax rates for taxes due in April 2022. The IRS tends to adjust tax rates, allowances, and thresholds every year based on inflation. Upcoming Tax Brackets & Tax Rates for 2021-2022 The bracket you fall under depends on several factors such as your taxable income, credits, deductions, and your filing status: single taxpayer, married couples filing jointly, or married filing separately. Seven tax brackets exist for the 2021 tax year or taxes due in April 2022 or October 2022, with an extension. Generally, you’ll pay more tax as you move up the pay scale, which is accomplished by creating income tax brackets that group taxpayers based on income ranges.

The United States operates under a progressive tax system that imposes a higher tax rate on taxpayers who have higher incomes. Income Tax Brackets-How is Your Income Tax Calculated?

0 kommentar(er)

0 kommentar(er)